This article was published in The August 2014 issue of The Gulf Magazine

Regulations and regulatory reforms are in vogue these days. The GCC has been witnessing a swathe of regulatory reforms in various sectors. How important is it to calibrate and balance reforms and regulations? This question has become hugely important in this setting.

Regulations and regulatory reforms are in vogue these days. The GCC has been witnessing a swathe of regulatory reforms in various sectors. How important is it to calibrate and balance reforms and regulations? This question has become hugely important in this setting.

Broadly speaking,

regulations have the following characteristics:

1. Counter-cyclical nature: We see that

policy makers wake up only when there is a disaster in the making! The global

financial crisis of 2008 is a great example, post which, a wave of regulations evolved

that was mainly aimed at the financial sector. We hardly see regulators active

when the going is good. This is actually counter intuitive. Strong regulations

should be introduced when the going is good, so that the stakeholders have the

energy and the time to pursue them effectively. Locking the stable after the

horses have bolted away does not make good sense!

2. Market Maturity: Regulations

can be illustrated as distillations of wisdom gained from ongoing market

experiments. Markets evolve over a period of time through multiple experiences

and regulations are nothing but an accumulation of such experiences. The

troughs and peaks as the markets waltz through time enable regulators to absorb

lessons and implement relevant checks and balances as part of the continuous

movement towards greater perfection. In

that sense, regulations are milestones that indicate the levels of market

maturity.

3. Investor Confidence: Properly

introduced regulations and reforms can go much towards enhancing investor

confidence. Lack of investor confidence primarily stems from a poor regulatory

architecture. A case in point is the emerging and frontier markets, which in

spite of its attractiveness, nevertheless suffers from poor investor confidence

(especially foreign investors).

4. Ease of Doing Business: Regulations

can go a long way in easing the way business is conducted. If enacted poorly, regulations

can also contribute to the opposite. It is generally considered a best practice

to measure the effectiveness and success of a particular regulation based on

how well it facilitates ease of doing business. Ease of doing business is

generally talked about in the context of foreign investors. I feel it does

apply in equal measure to local businessmen.

5. Global Perception and Brand Building: Regulations can also contribute to enhanced and improved

global perception about a particular market. Preservation of investor rights,

intellectual property, speed of legal trials, can be cited as some examples

that lead to the strengthening of a particular location or city as a brand

(e.g.,Singapore). Major decisions, including setting up of manufacturing units,

are critically based on the strength of global perceptions.

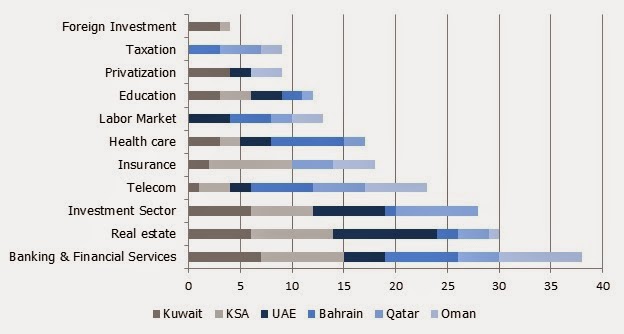

In the context of the

aforementioned characteristics or essential features of regulations, it is

worth mapping the framework to the GCC environment. The below chart illustrates

the number of reforms, sector wise in the GCC, since 2008. It is interesting to

note that foreign investment is an area where there have been only subdued

regulatory movements; while Banking and Financial Services has witnessed

intense regulatory pronouncements. There can be reasons for this. Attracting

inward foreign capital may not be an immediate priority for liquidity rich GCC

states. However, FDI is just not about attracting capital, only. Foreign

investment can also enhance the talent pool in the region, bring new

technologies, and above all, improve investor confidence and upgrade global

perception. On the contrary, Banking and Financial Services is a dominant and highly

mature sector contributing to over 50% of the market capitalization in the

respective stock markets of the GCC countries. In the absence of an active debt

market and due to a paucity of long-term funding instruments, banks end up

being the primary mover of the financial wheel. This explains the “over

regulated” nature of this sector.

Indicative Number of

Reforms in GCC (2008-2013)

Source:

Markaz Research

So, what then makes regulations effective?

1.

Balance: Under regulation may

inhibit the growth of a sector; while excessive regulations may increase the

cost of doing business. Hence, the need to balance regulations carefully.

2.

Oversight: Declaring

a regulation is only the opening gambit, while the real challenge lies in the implementation

on the ground. A case in point are the Capital Market Authorities across many

GCC countries. While CMAs’ require a spate of documentation to be submitted by

the companies, they may not have the commensurate infrastructure or technology

to monitor all the submissions and take action where necessary.

3.

KPI's: Regulations become

effective only when regulators don’t limit their role to just policing and fining.

The agenda of regulators should be more broad based and should include the

development and growth of the sectors that they are regulating. If after a

decade of regulations, a sector has failed to demonstrate growth and

development, then the regulators should also share the blame!

4.

Cost: Mindless regulations

should be avoided as compliance cost is an important component with respect to economic

efficiency. This is particularly true of “imported regulations”, which under

the name of best practices, are whisked in with little consideration given to

their applicability vis-à-vis local realities.

In summary, it can be said that there can be no doubt about the

integral and important role that effective regulations have. The role that they

play in the organized development of a market cannot be understated or

deemphasized. However, calibrating regulations and achieving a fit balance is

the need of the hour.

.jpg)

No comments:

Post a Comment